A fresh look at insurance

The burst of energy that comes with spring helps us look ahead and set goals for the future, and that may involve taking a fresh look at your insurance cover.

Like the seasons, life’s constantly changing. Having financial protection that continues to meet your needs through these  changes is as important as an umbrella in winter.

changes is as important as an umbrella in winter.

Everyone’s needs are different, so when it comes to insurance—whether it’s life, income protection, trauma or total and permanent disablement cover—it’s not simply a case of set-and-forget.

|

Financial protection when you need it most:

|

Do you need more?

Every day, underinsurance combined with an unexpected event has a significant impact on the finances of Australian families. The typical Australian family will lose half or more of their income following a serious illness, injury or the loss of a parent[1].

Insurance levels can be adjusted as your needs change. Over time you may extend your mortgage or take on new financial commitments and having too-little cover in place could leave you short-changed down the track.

You may need less…

Similarly, you only want to pay for what you need.

As you get older your debt levels may reduce. Say you’ve paid off your home and have minimal debt or the kids are financially independent—you may no longer need as much insurance. That’s when your cover can be scaled down.

Our tomorrows are changing

It pays to look ahead when considering your insurance needs.

With the Australian divorce rate at 42 per cent, many blended families are changing their debt levels in later years and single people are bearing their responsibilities independently.

While the majority of Australians are healthier and living longer, we know that more than half of 65-year-olds are living with some form of disability. That’s when insurance can help to ensure that you have the quality of life you deserve.

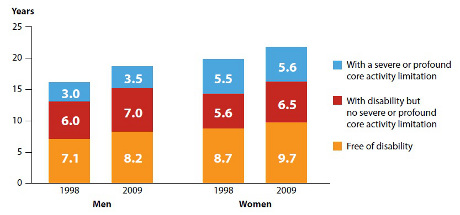

Expected years of life for men and women aged 65 in 1998 and 2009. People aged 65 have an increased life expectancy with more than half the increased time expected to be spent in good health. Women aged 65 can expect to live longer than men of the same age, but with more time in poor health.[2]

Spring into action

With only five per cent of Australian families currently holding a level of cover that matches their circumstances, it’s time to make sure your insurance cover fits your needs[3].

Spring into action and see if you’ll be better-off by increasing or reducing the level of cover you have. Call us today on 02 4782 1148, so you’ll be better-off tomorrow.

Dr Simon Kelly and Dr Quoc Ngu Vu. (2010) Journal of Financial Advice, (Volume 3, Issue 3. The economic cost of underinsurance for a typical family. natsem.canberra.edu.au

[2] Australian Institute of Health and Welfare. (2012). Australia’s health 2012: in brief. Cat. no. AUS 157. Canberra: AIHW.

[3] Dr Simon Kelly and Dr Quoc Ngu Vu. (February 2010). The Lifewise/NATSEM Underinsurance Report: Understanding the social and economic cost of underinsurance. natsem.canberra.edu.au

What you need to know

Any advice contained in this article is of a general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regard to those matters. If you decide to purchase or vary a financial product, your financial planner, our practice, AMP Financial Planning Pty Ltd and other companies within the AMP group will receive fees and other benefits, which will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. You can ask us for more details.